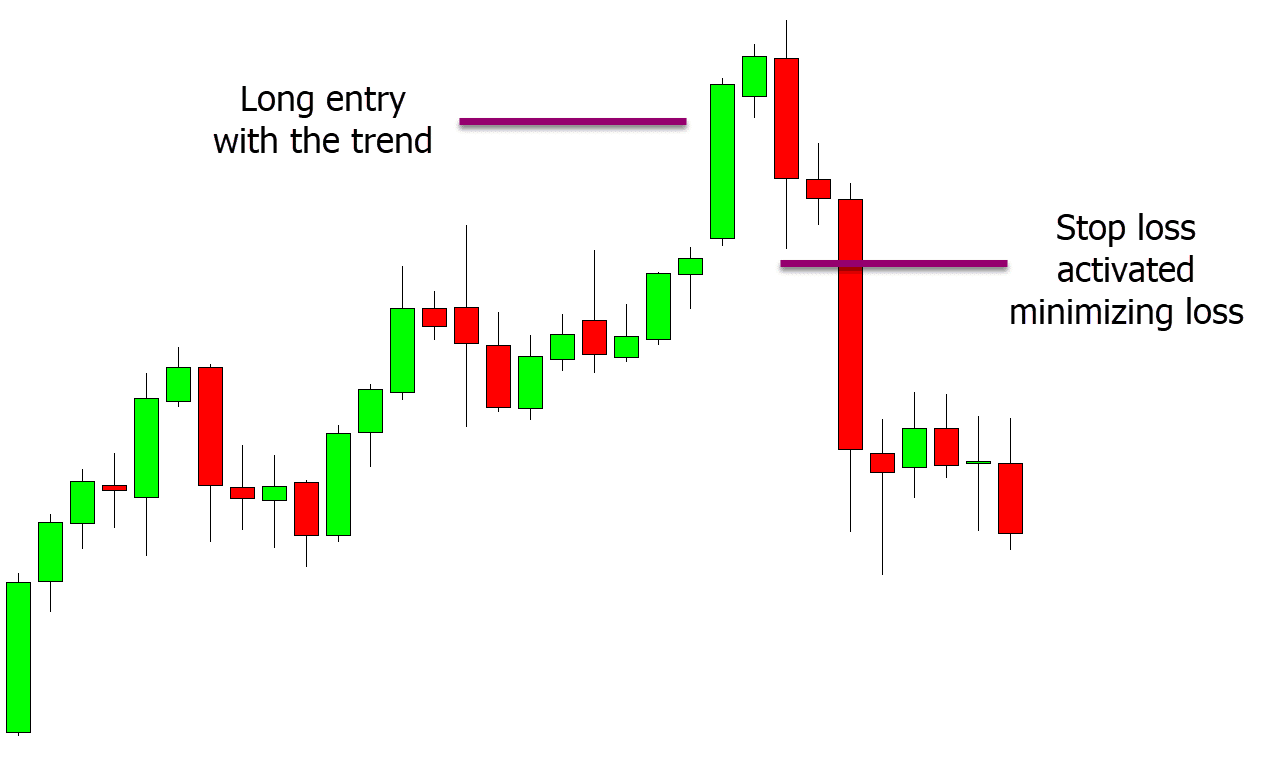

This is another simple strategy that should always be followed but is not.

Using a smart stop loss can ensure you have small losses and then capitalize on your winners.

The best stop loss placements will be at levels where the trade has failed, and instead of having a large loss, you cut it quickly.

Calculate Your Risk for Each Trade

If you correctly calculate your risk on each trade, then you can make sure you are risking the right amounts.

For example, some traders will not calculate how much they should be trading each trade and will use the same amount. If you do this, you could risk wildly different amounts on different pairs and stop-loss levels.

The best way to control your risk is to have set rules. For example, you will only risk 2% of your account each trade. Before each trade, you use a position size calculator to work out how much you should be trading, so you never risk too much.

Money Management Strategies for Serious Traders

If you are a serious trader, you will use other more advanced strategies to ensure your losses stay small and your winners put you in profit.

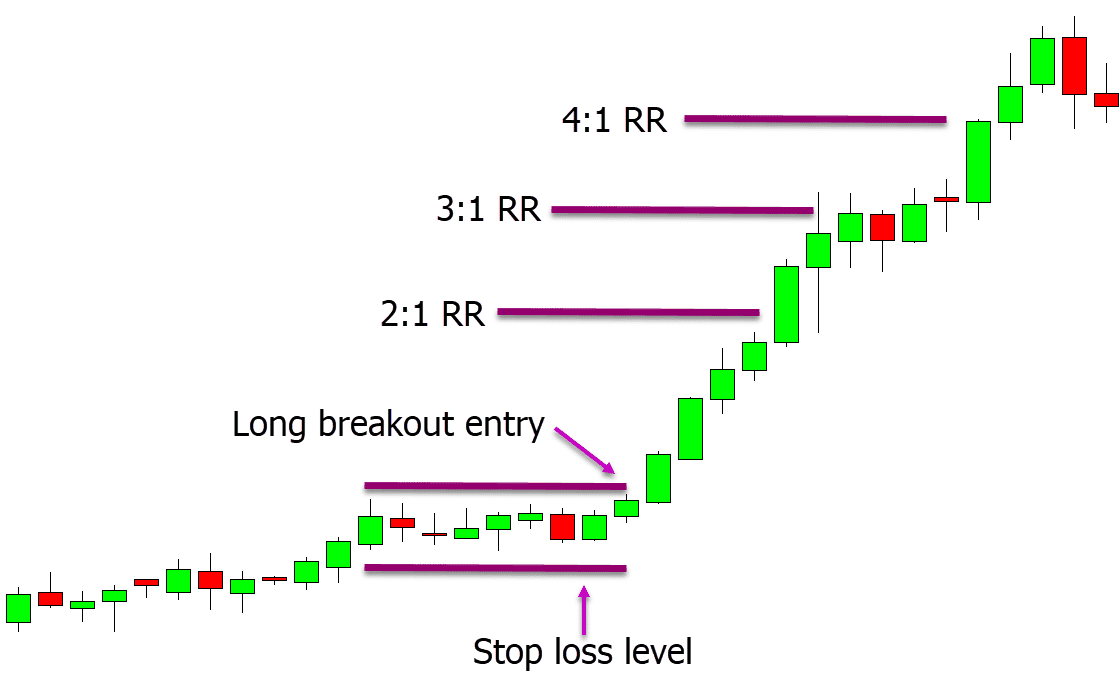

Have a Minimum Risk-Reward Ratio

A minimum risk-reward ratio for each trade you take will ensure you can come out profitable even after taking on losses.

In the example below, we are taking a long breakout trade. If the price moves lower into our stop loss level, we will automatically stop out of the trade.

However, in this example, the price moves higher and we could take profit at four times that amount we risked or 4:1 risk-reward. This means that if we were risking 2% on the trade, we would have profited 8%.

Use Leverage Wisely

Leverage is a double-edged sword. You can use it t boost your winners into much larger winners, but it can quickly crush your account if not used correctly.

The best way to make sure you are not using too much leverage is to calculate what trade size you should be using before each trade.

Like in the example above, if we are going to risk 2% each trade, we would use a position size calculator before opening a new trade.

As our account gets bigger or smaller, we would continue risking 2% and making sure we are not using too much leverage.

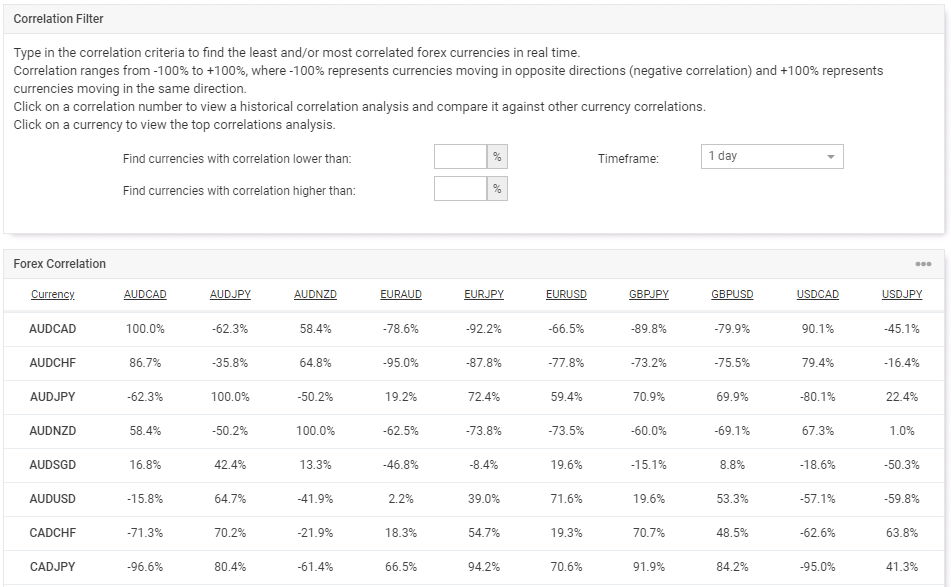

Follow Currency Correlation

Correlation in the Forex market is something you always need to consider if trading more than one pair.

If you don’t use correlation wisely, you can quickly risk more money than you wanted.

For example, the EURUSD and GBPUSD can have up to 90% correlation on the daily time frame. Therefore, if you entered trades on both of these Forex pairs, they are highly likely to move in the same direction. This would mean you would have two winning trades or two losing trades.

You can use a correlation calculator from investing.com to quickly see any potential positive or negative correlation your trades might have.

Leave a Reply