In the very first lesson on the basics of cryptocurrency we explained that Bitcoin represents a new phase in the evolution of sound money, through the achievement of digital scarcity.

Please go back and refresh your memory, if the concept still isn’t clear, because scarcity is fundamental to the success of any store of value or medium of exchange.

Given its critical importance, you cannot simply take it as given that Bitcoin has that property, you have to look at objective measures.

When we talk about scarcity, what we are essentially saying is:

- How well is Bitcoin sticking to its overall objective of a fixed cap on new coins?

- How effective and predictable is Bitcoin at adding new coins to the overall supply?

Bitcoin’s protocol – its rules – state that there will only ever be 21 million bitcoin in existence – this is the commitment to scarcity. So how do we measure that?

The Bitcoin network is open source, enabling services like Blockchain.com to look at the number of Bitcoin mined and know exactly what the circulating supply is.

This enables anyone to objectively understand not only the supply right now, but the rate at which that supply has been changing since Bitcoin launched, and whether this means it is on target to reach maximum supply.

This can be checked against the claims made by Bitcoin’s creator – in the 2008 Whitepaper – which over time reinforce the integrity of the claim to digital scarcity.

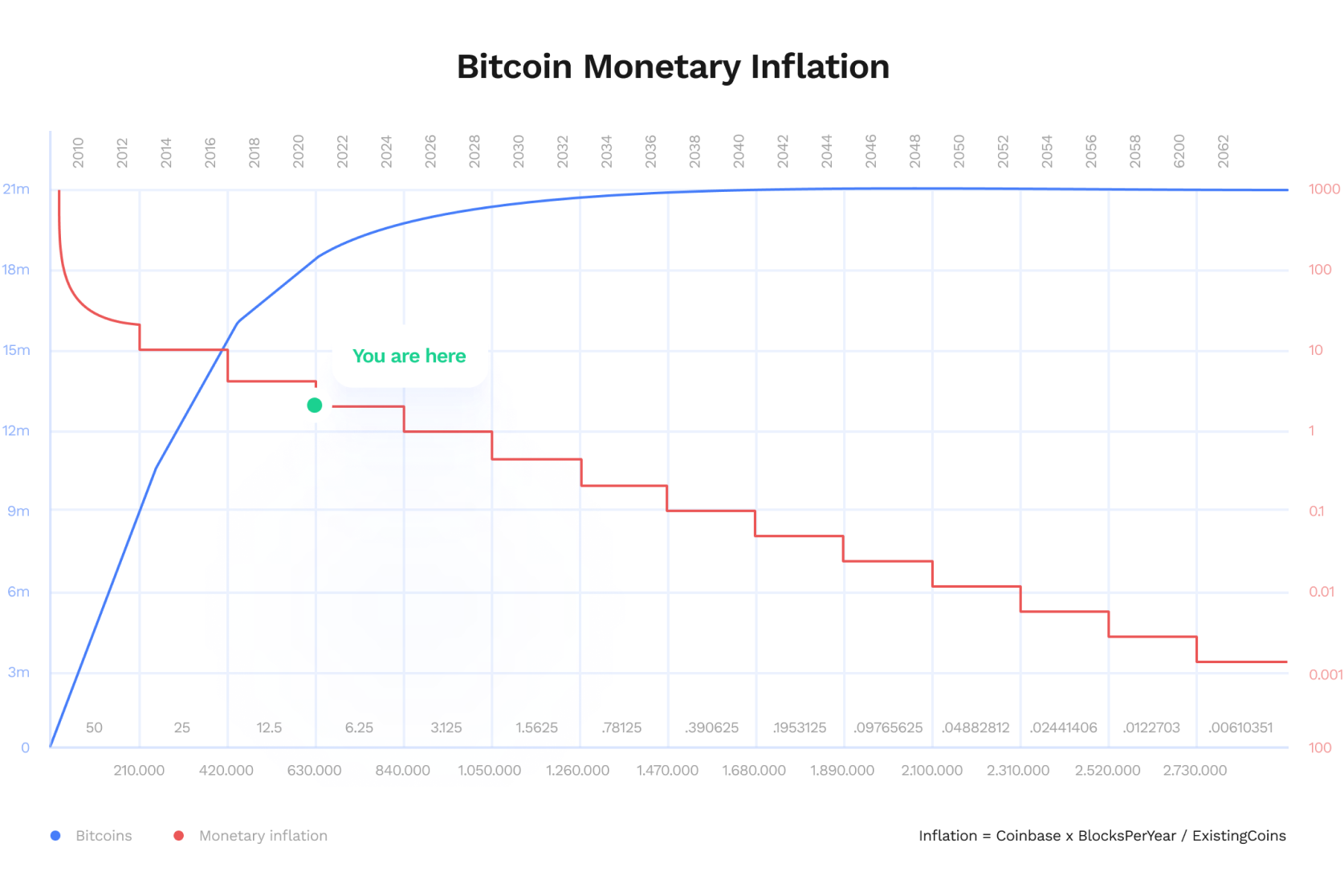

Based on the predictable growth in supply seen, we can predict the maximum supply of 21 million bitcoin will be reached in the year 2140.

You will often see a chart of the total supply of bitcoin shown in conjunction with a measure of inflation – showing the rate that the supply is growing each year.

Inflation is a measure we should all be familiar with, telling us how much the price of goods, for example, are going up each year.

In order for Bitcoin to be an effective store of value, inflation should decrease over time i.e it should be disinflationary. It must inflate – increase its supply – in order to reach its maximum cap, but it has been specifically designed so that the rate at which it does decreases in a predictable way over time. This issuance model can also be effectively measured.

Leave a Reply