Bitcoin went live in January 2009, based on a set of rules – the Bitcoin Protocol – that included a clearly defined supply schedule:

- New bitcoins are created through Mining. Miners compete to process a new block of transactions by committing computing power to solve a mathematical puzzle. They do this by running a set algorithm hoping to find the answer – this is known as Proof of Work.

- A new block is mined roughly every ten minutes. The system is self-regulating, through a difficulty adjustment of the mining algorithm every two weeks, to maintain the steady rate of block creation.

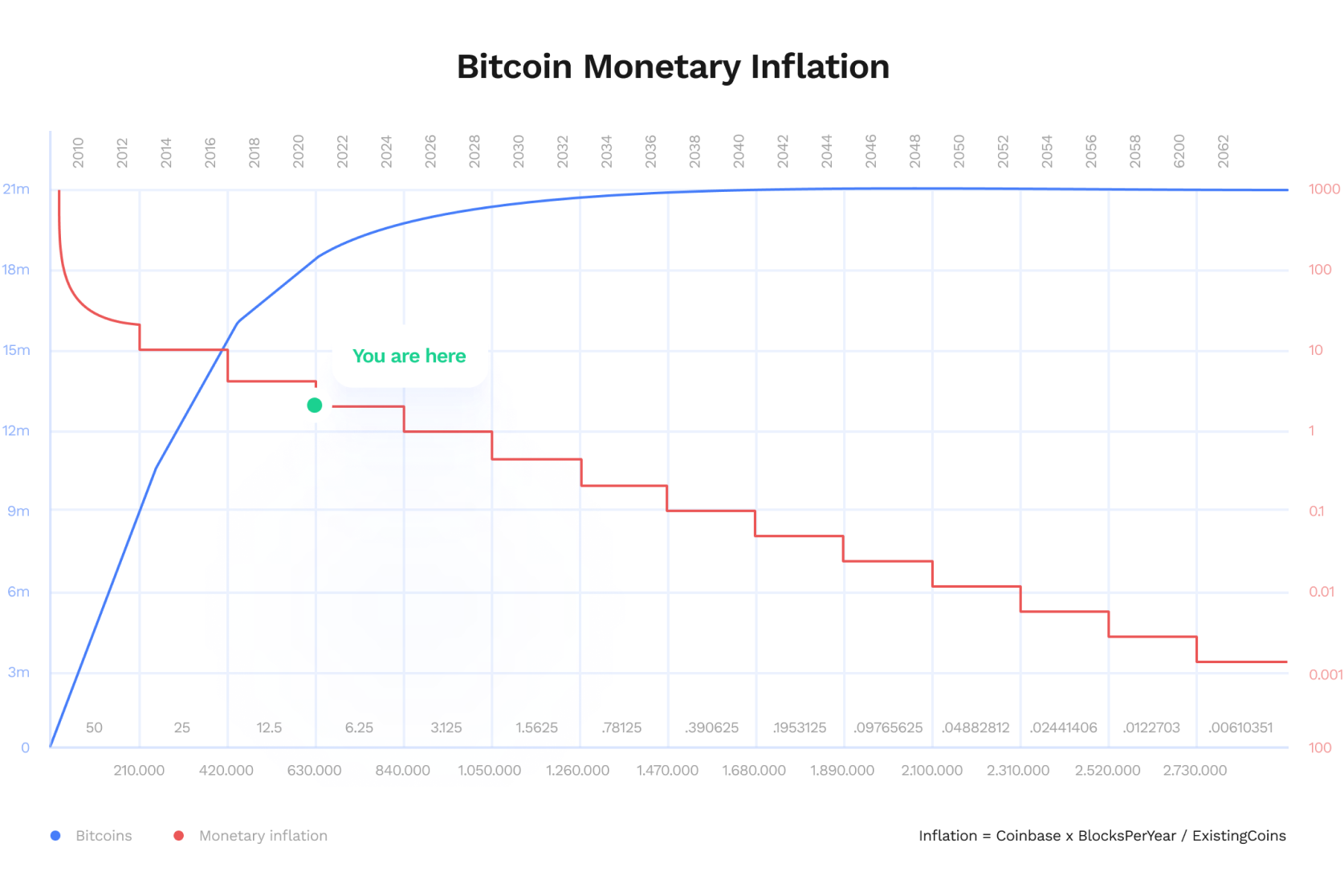

- The mining reward began at 50 BTC in 2009, but halves every 210,000 blocks – roughly four years. There have been three so-called halvings – the last in May 2020 – with the block reward now set at 6.25 BTC.

- This fixed supply schedule will continue until a maximum of 21 million bitcoin are created.

- There is no other way that bitcoin can be created

- Along with the block reward, successful Miners also receive fees that each transaction pays to be sent over the network

The importance of Bitcoin’s fixed supply schedule to perceived value cannot be overstated. It enables us to know Bitcoin’s inflation rate over time – its programmed scarcity.

It also tells us that as of January 2022, 90% of Bitcoin supply has been mined and that the maximum supply will be reached in around 2140, at which point the only reward Miners will receive will be the transaction fees.

The supply schedule is a critical piece of the tokenomics puzzle. If a coin has a maximum supply this tells you that over time inflation will decline to zero, at the point the last coins are mined (see the graph above). This quality is described as disinflationary – as supply increases but at a decreasing marginal rate – and is a valuable characteristic for something to function as a store of value.

If there is no maximum supply this means that tokens will keep being created indefinitely, and potentially diluting value. This is true of the existing fiat monetary system, and one of its biggest criticisms along withe the uncertainty that surrounds the changes in supply.

To know whether the supply of fiat money is expanding or contracting – with the obvious knock on effects to the its purchasing power and the wider economy – you have to wait anxiously for the outcome of periodic closed door Federal Reserve or ECB meetings. Contrast that with the certainty that Bitcoin’s fixed supply schedule provides, which even allows scarcity-based models to predict its value.

Supply Metrics

As the first example of a cryptocurrency, Bitcoin effectively introduced the concept of tokenomics, along with a set of metrics that breakdown the supply schedule of any cryptocurrency into key components that give valuable insight into potential, or comparative, value.

These common yardsticks are published on popular crypto price comparison sites like Coinmarketcap or Coingecko as a complement to the headline price and volume data.

- Maximum Supply – A hard cap on the total number of coins that will ever exist. In the case of Bitcoin 21 million.

- Disinflationary – Coins with a maximum supply are described as disinflationary or deflationary, because the marginal supply increase decreases over time.

- Inflationary – Coins without a maximum supply are described as inflationary because the supply will constantly grow – inflate – over time, which may decrease the purchasing power of existing coins.

- Total Supply – The total number of coins in existence right now.

- Circulating Supply – The best guess of the total number of coins circulating in the public’s hands right now. In the case of Bitcoin, Total Supply and Circulating Supply are the same thing because its distribution was broadcast from day one.

- Market Capitalisation – The Circulating Supply multiplied by current price; this is the main metric for measuring the overall value and importance of a cryptocurrency, just as it is for public companies which multiply share price by number of tradable shares.

- Generally abbreviated to Marketcap, it is often used as a proxy measure for value, and though it is helpful in a comparative sense, its reliance on price means that it reflects what the last person was prepared to pay, which is a very different thing to estimating fundamental value.

- Fully Diluted Market Capitalisation – The maximum supply multiplied by current price; this projects an overall value of the fully supplied coin, but based on current price.

Leave a Reply