Whereas the Supply Schedule tells you what the currently Circulating Supply is and the rate at which coins are being created, Supply Distribution takes into consideration how coins are spread among addresses, which can have a big influence on value, and is another important part of tokenomics.

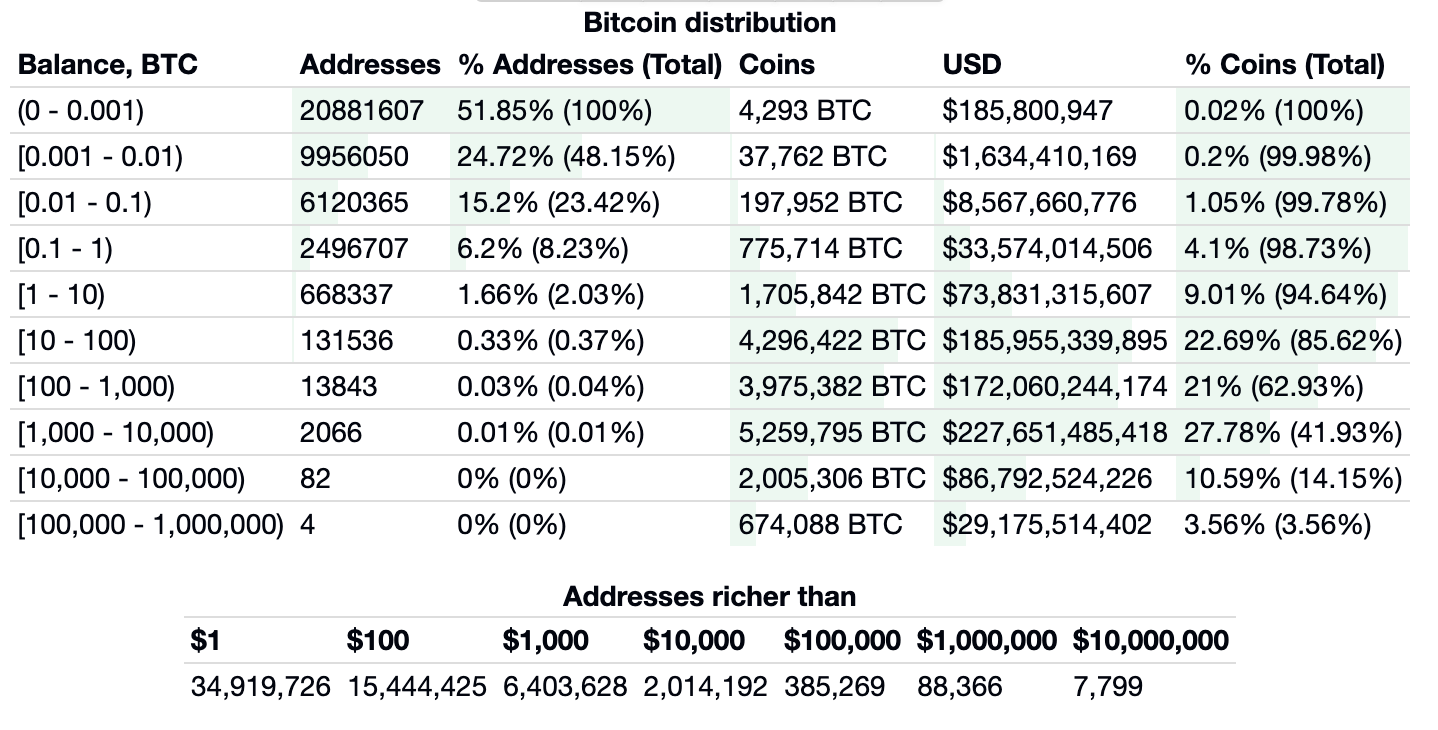

Given cryptocurrencies like Bitcoin are open source, this information is freely available to anyone with an internet connection and some data analysis skills. Here’s the distribution of Bitcoin as of January 2022 courtesy of Bitinfocharts.com.

The raw supply distribution for Bitcoin doesn’t look particularly healthy, with less than 1% of addresses owning 86% of coins, which would suggest that is vulnerable to the actions of the smaller controlling addresses.

But this picture is somewhat misleading, as an individual will have numerous addresses, while one address might belong to an entity – like an exchange – which holds custody of Bitcoin on behalf of potentially millions of users.

Analysis by blockchain analytics provider, Glassnode, suggests that concentration is nowhere near as dramatic, and that the relative amount of bitcoin held by smaller entities has been consistently growing over time.

So though the Bitcoin blockchain is transparent, address ownership is pseudonymous, which means that we can infer certain information about the concentration of crypto ownership, and use this to provide insight in to value, but never really know the true supply distribution at a granular level.

This has spawned an entirely new field of analysis called on-chain analytics – the closest thing to blockchain economics – which uses patterns in address behaviour to infer future price movement.

Leave a Reply