Cost averaging, also known as dollar cost averaging, or DCA for short, is a way to gain exposure to crypto that mitigates the risk of buying at the top of the market, by making regular, small and consistent investments over time,

Imagine you intend to invest $1,000 of BTC, but are uncomfortable about when to buy, because of the volatility, or don’t have access to a lump sum.

Stacking SatsThis phrase is the crypto equivalent of saving pennies. It encourages the regular buying of small amounts to gradually build your investment. A Sat – short for Satoshi – is the smallest denomination of Bitcoin.

Instead, you could choose to cost average, buying $100 BTC per week for 10 weeks, at exactly the same time, without even considering the price. During that time, the price of bitcoin may go higher or lower than your initial entry price, but the cost average of your purchase would even out.

Bitcoin cost averaging has been shown to be one of the most profitable investment methods over several years, consistently outperforming most other strategies.

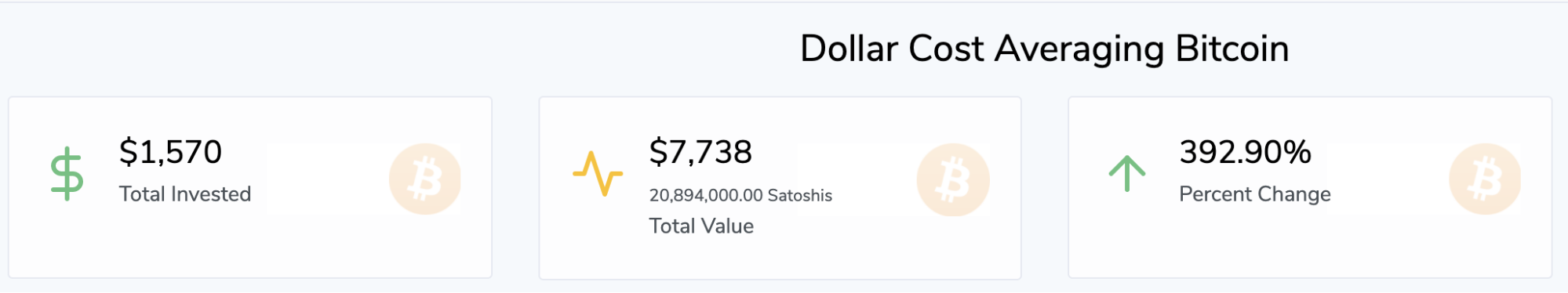

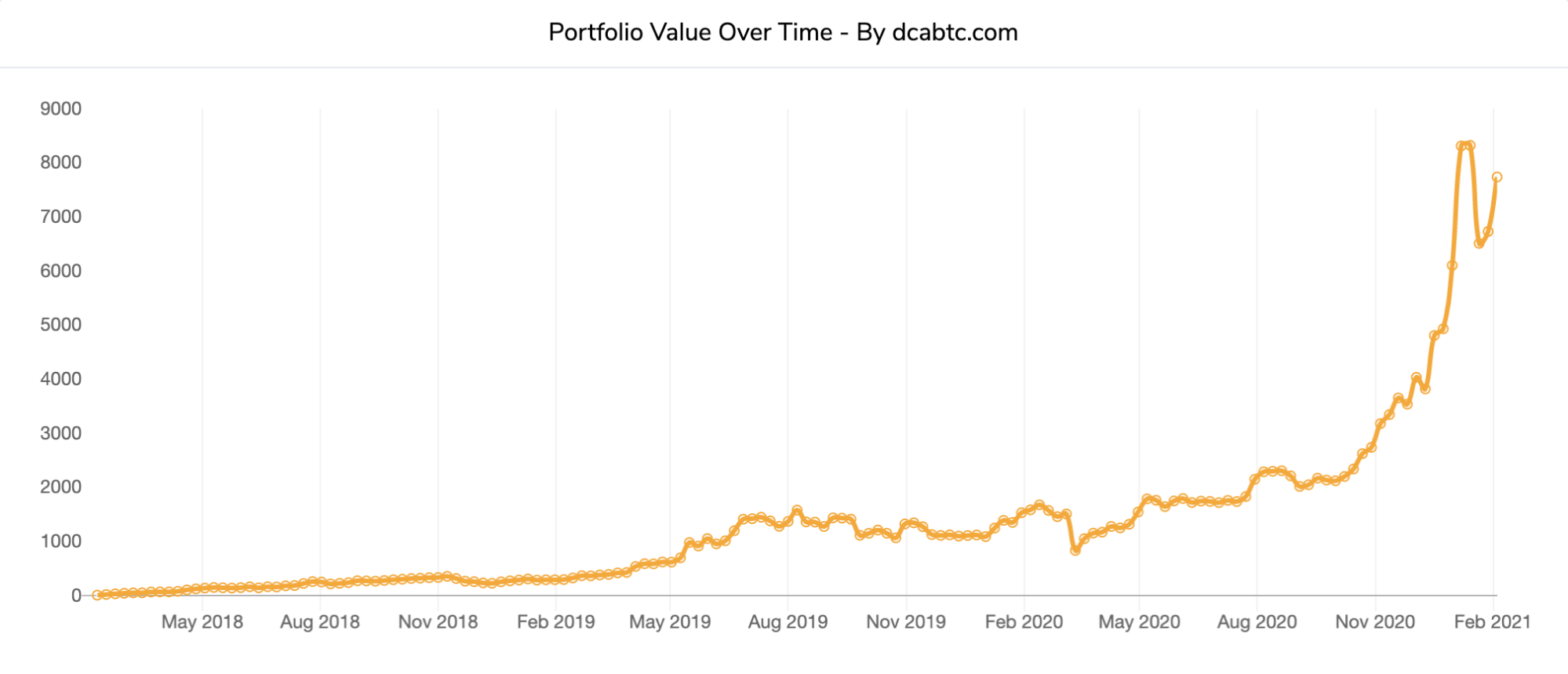

Websites such as dcabtc.com allow you to calculate the profit you would have made by cost averaging into bitcoin at any point in time. Using a three year time frame from February 2018 to February 2021 dollar cost averaging would have produced a 392.9% return on your investment.

You can even compare your investment to other assets such as Gold, which would have produced a mere 23% return, which isn’t adjusted for inflation.

The benefits of cost average cryptocurrency like Bitcoin are such that many exchanges include recurring purchase functions to facilitate DCA for you. You just need to connect a payment method and let time and the store of value properties of Bitcoin do their work.

Leave a Reply