The process of identifying a fair value for bitcoin is called price discovery. Every market participant will in theory be utilising all available information about bitcoin – Technical, and Fundamental – as well considering the behaviour of other market participants to discover the true price.

We’ll unpack the influences on price discovery later in the section, but at this point our attention is just on introducing the idea that price is discovered by market participants and trading facilitated by exchanges.

Exchanges match buyers and sellers – looking to express their opinion about price via trades – continuously 24/7/365, generating bitcoin’s price – and this is where price comes from; an agreement on perceived value at a specific point in time..

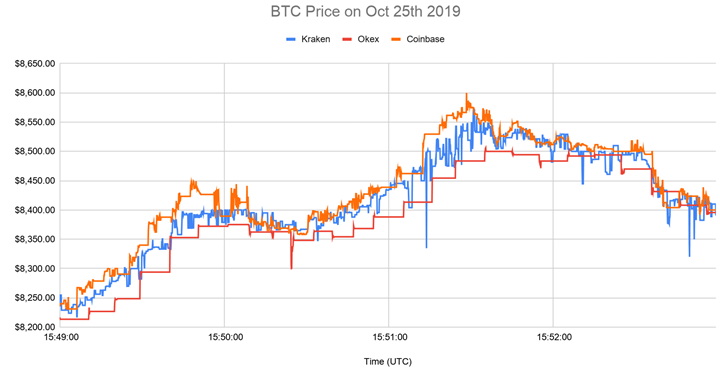

Each exchange platform functions independently, matching the supply (sellers) and demand (buyers) of its own customers,; there is no single source of price truth for bitcoin outside of exchanges.

Price aggregators, such as Coinmarketcap, pull in prices from the largest exchanges and use a weighted average – taking into consideration the volume of transactions – to produce a broad price value .

You’ll see from the image below that there is price differential among the top ten exchanges contributing trading volume for bitcoin. That difference is greater where the Trading Pair is different.

The aggregated exchange data from Coinmarketcap can be considered reliable enough to represent a price benchmark for bitcoin but as the ability to buy bitcoin varies around the world, price discovery can be distorted.

Leave a Reply