Another crypto trading strategy that is suitable for someone who is just getting started, and may lack the technical understanding and time commitment, is Momentum Trading – also known as Position Trading.

Momentum Trading is essentially a more sophisticated version of hodling. A hodler will buy and hold – that is it. Momentum or Position Trading will be looking for entry points based on significant points of momentum change in the market. This might mean identifying the start/end of specific cycles.

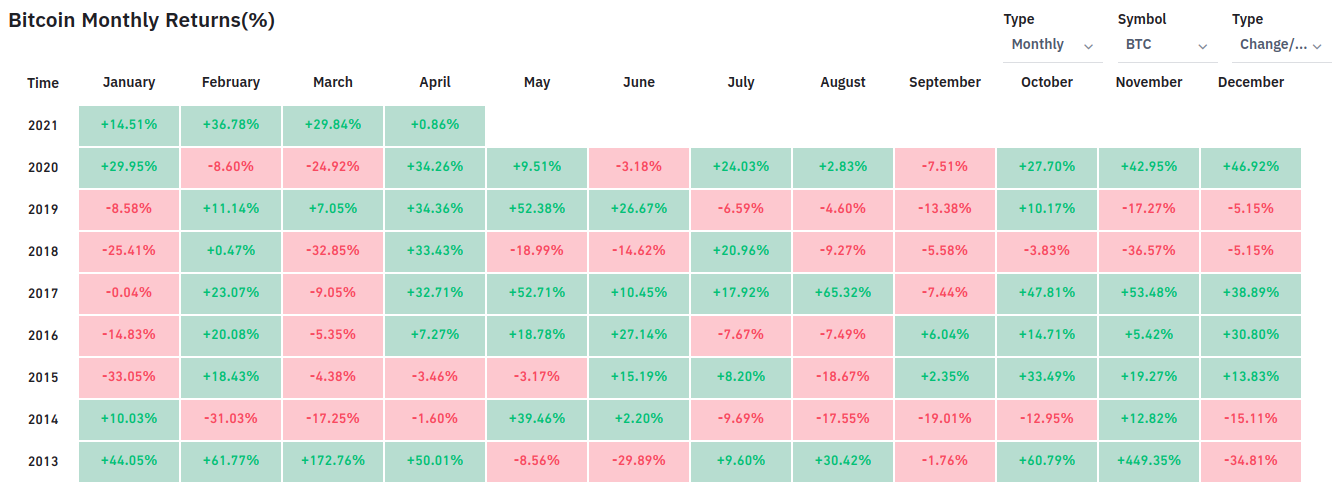

The most obvious are bull/bear cycle or halving periods, but can include calendar based cycles – such as the significance of March and the end of the financial year translating into price declines, as contrasted by the gains that tend happen in April. This image from Coin Telegraph tells that story. or anything from political cycles (due to elections), weather and its impact on hydro-electric mining.

Ark are a good example of an investment firm that are specifically focused on taking positions within emerging technologies.

Pros

- Potential for significant Return on Investment (ROI)

- Passive/Not time sensitive

- Fundamental analysis ore intuitive than Technical Analysis based strategies

Cons

- Requires funds to be locked up for long periods

- Risk of significant losses as doesn’t suit a Stop-loss approach

Leave a Reply