Before we dig into the specifics of a bitcoin transaction it is worth explaining a little bit about the logic of Bitcoin transactions, and try to draw analogies to something you should be familiar with, banking transactions.

Your bank account has a running Balance, which is the aggregate of Debits and Credits, it shows you how much many you have to spend.

Debits are transactions that spend against your Balance, and Credits are transactions that increase your Balance.

Bitcoin works in a similar way but with slightly different language and logic:

- Unspent Funds – These are funds are available to spend. Your Bitcoin wallet will total all unspent funds associated with addresses that it holds to create a Balance. You’ll see these described as UTXOs. Essentially transactions that have been received and not moved on.

- Spent Funds – When you make a transaction you access Unspent Funds, sending them on to a new address, at which point they become Spent.

So the Bitcoin blockchain is a record of forward movement of funds. Unspent funds associated with addresses, specific locations on the blockchain, which are Spent in order to fund a transaction which moves them somewhere else on the blockchain, That movement being facilitated by Miners.

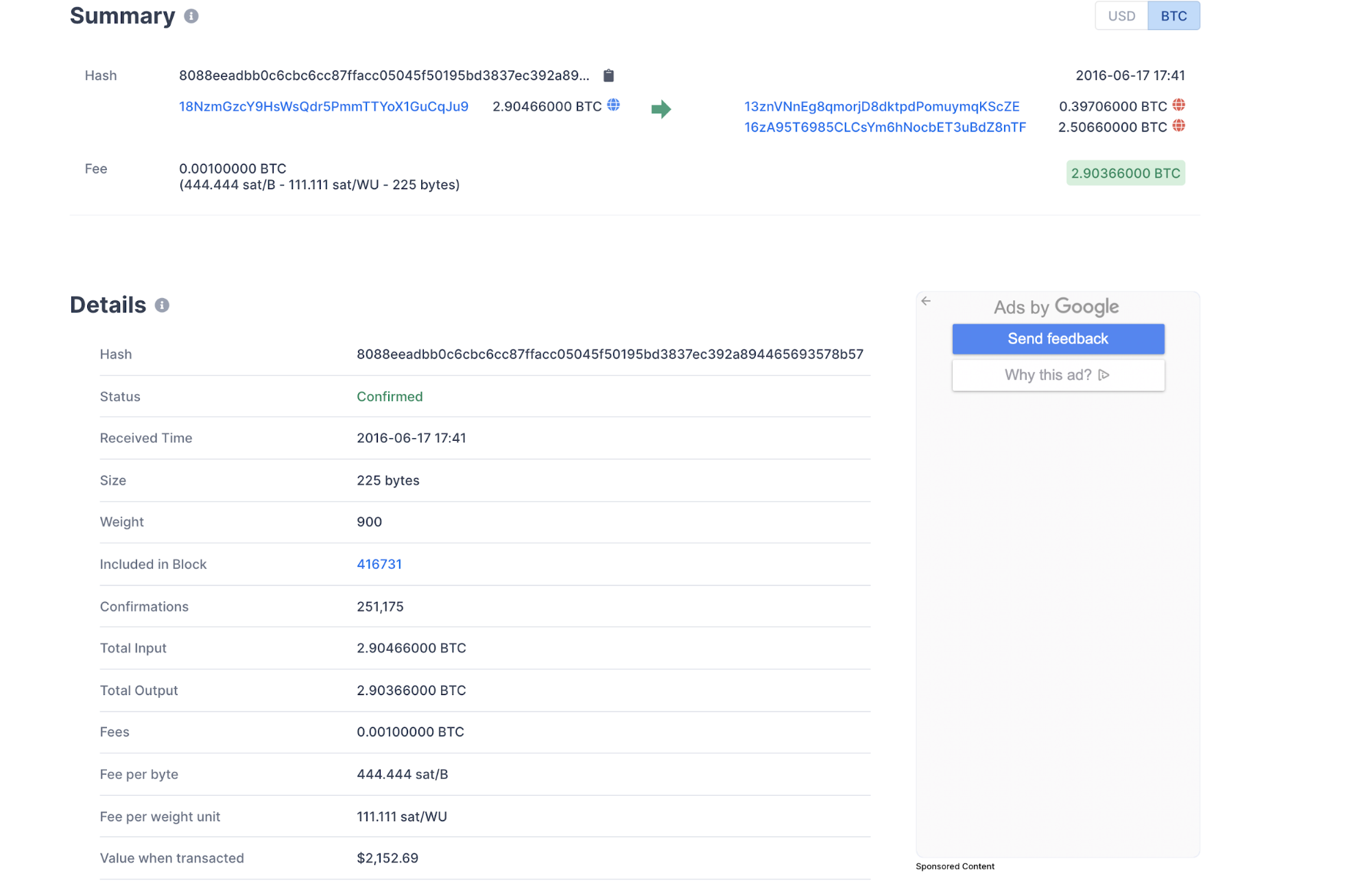

The spending of funds is described within a transaction, showing the destinations and the fees. This movement is described by Inputs and Outputs.

- Inputs – The source of the Unspent funds, which are moved in the transaction and become Spent

- Outputs – The destination of Spent funds which become Unspent at a new address.

It isn’t the most intuitive system but a Bitcoin transaction is all about the forward flow of funds. If you send BTC you need Inputs – to fund the transaction – which are themselves the end product (Output) of a previous transaction.

Once sent the transaction is processed (minus fee) the funds are spent from the Input and become an Unspent transaction at a new address – the Output.

Leave a Reply