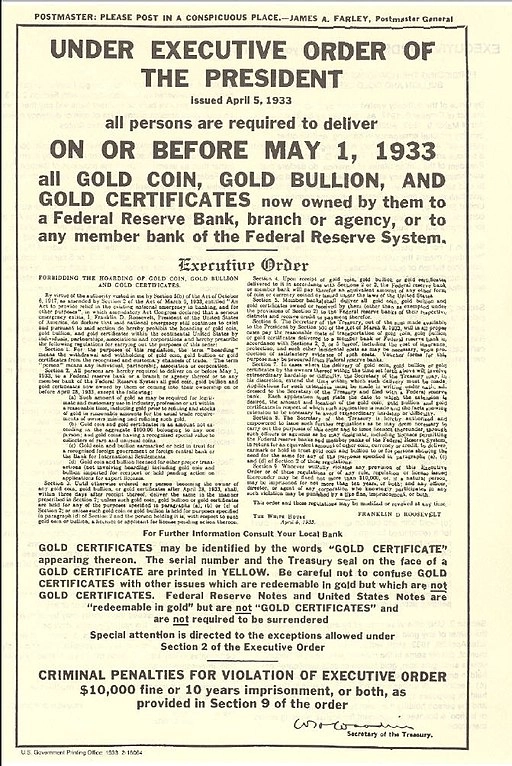

This was the beginning of what we call the “gold standard” – paper money, backed by gold. This continued until 1971, when US President Richard Nixon changed the rules, allowing governments to create money without any mechanism for converting it into an equivalent amount of gold.

The Gold Standard Refers to the backing of notes and coins in circulation with an equivalent of gold lodged with a central bank. Money supply can only grow if an equivalent amount of gold is added to bank reserves.

Of course we now know that this breaks one of our golden rules of sound money – scarcity. The new system instead requires us to simply trust our governments to decide how much money should be created and for what purpose. This is known as Fiat Money, which literally means – this is money because the government says its money.

In retrospect we should have known that the combination of trust, government and money would end badly.

$27 trillion

The US National debt is currently over $27 trillion

and rising (watch it go up in real time here).The reason scarcity matters is that creating more money (known as increasing the money supply) makes the money you might have saved worth less; this is called inflation. In countries that totally lose control of their money you get hyperinflation, when your money is worth nothing.

As the saying goes, trust comes in on a snail and rides off on a horse, so how do you get back to sound money and regain people’s trust?

Leave a Reply